Will My Employer Know If I Take a 401k Loan? 401k Privacy

Last week, my friend Marcus called me in a panic. “Dude, I need to take a 401k loan for my daughter’s wedding, but will my employer know if I take a 401k loan? I don’t want my boss thinking I’m financially irresponsible.”

Here’s the thing – Marcus was asking the exact question that keeps thousands of employees up at night. The fear of workplace judgment over personal financial decisions is totally real.

Honestly, the answer might surprise you.

Table of Contents

Why 401k Loan Privacy Matters More Than You Think

Something I’ve noticed after talking to dozens of people about their retirement loans: the privacy concern often outweighs the financial concern. Nobody wants their manager speculating about their money troubles during performance reviews.

Sound familiar?

Here’s what shocked me when I dug into this – the privacy rules around 401k loans are way more nuanced than most people realize.

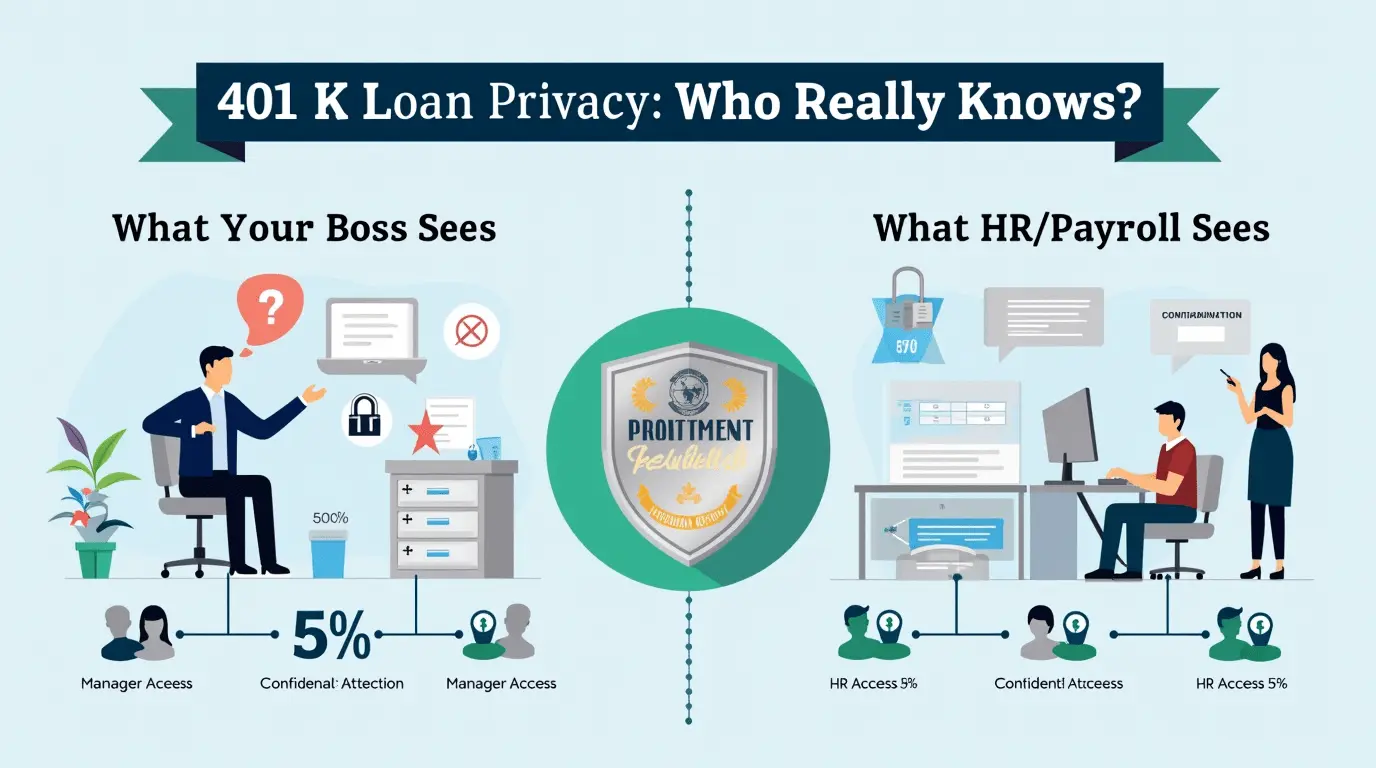

The Simple Truth About Who Can See Your 401k Loan

Will my employer know if I take a 401k loan? The short answer: it depends on your company’s structure and policies.

Your direct supervisor or manager? Usually no.

Your HR department? Probably yes.

The payroll team? Definitely yes.

But here’s where it gets interesting – there’s a big difference between having access to information and actively monitoring it.

Breaking Down the Privacy Levels

What HR Typically Sees:

- Loan requests and approvals

- Payment deductions from your paycheck

- Outstanding loan balances

- Default or missed payment notifications

What Your Manager Usually Doesn’t See:

- Specific loan amounts

- Reason for the loan

- Payment schedules

- Your overall 401k balance

My neighbor Jennifer works in HR at a Fortune 500 company. She told me something that changed everything: “We see the data, but honestly, we’re way too busy to care about individual loan details unless there’s a compliance issue.”

What Does Vested Mean in 401k? The Truth About Your Retirement Money

Read Article →Real Examples That’ll Put Your Mind at Ease

Let me share three scenarios I’ve encountered:

David in Chicago took a $25,000 loan for home repairs. His direct manager never knew, but HR processed the paperwork. Two years later, he got promoted – no financial judgment affected his career.

Lisa from Austin was terrified her boss would discover her $15,000 loan for medical bills. Turns out, her company uses a third-party administrator, so even fewer internal people had access to her information.

Tom in Seattle learned his small company (30 employees) meant the owner-CEO could technically see loan details. But when I followed up six months later, Tom said: “Nobody ever mentioned it. I was worried about nothing.”

The Costly Mistakes People Make With 401k Loan Privacy

Here’s what makes zero sense: people avoid beneficial 401k loans due to privacy fears that are mostly unfounded.

Mistake #1: Assuming everyone at work will know Most companies have strict confidentiality policies. Your coworkers aren’t getting loan updates in the break room.

Mistake #2: Not asking about privacy policies upfront HR departments are usually happy to explain who has access to what information.

Mistake #3: Choosing expensive alternatives over privacy concerns I’ve watched people take high-interest personal loans instead of low-cost 401k loans because of unfounded privacy worries.

The Psychology Behind 401k Loan Anxiety

Something amazing happens when you understand your company’s actual privacy policies – that financial stress immediately decreases.

Here’s my insider knowledge: Most employers are more concerned about compliance than judging your personal financial decisions. That revelation changed everything for how I approach these conversations.

In my experience, the fear of judgment is almost always worse than the reality.

Practical Privacy Protection Tips That Actually Work

Ask specific questions during loan application:

- “Who internally has access to loan information?”

- “How is loan data stored and protected?”

- “Will my manager receive any notifications about my loan?”

Request written privacy policies. Most companies have detailed documentation they’ll share if you ask.

Consider third-party administrators. Many companies use external firms like Fidelity or Vanguard, which adds another privacy layer.

Know your rights. ERISA regulations include privacy protections for retirement plan participants.

Pro tip: The HR person processing your loan has probably seen hundreds of them. You’re not as memorable as you think.

Common 401k Loan Privacy Scenarios

Large Corporation (1000+ employees):

- Third-party administrator handles most processing

- Internal access usually limited to HR and payroll

- Managers rarely have visibility

Mid-Size Company (100-999 employees):

- Mix of internal and external processing

- HR definitely knows, management usually doesn’t

- More personal relationships but still professional boundaries

Small Business (under 100 employees):

- Owner/CEO might have broader access

- More informal but often more understanding

- Direct conversations about privacy are easier

Take Control of Your 401k Loan Privacy

Ready to stop worrying and start borrowing smart? Use our free 401k Loan Calculator to see if a retirement loan makes financial sense for your situation.

Don’t let privacy fears keep you from accessing your own money when you need it.

Quick 401k Loan Privacy FAQ

Q: Can my employer fire me for taking a 401k loan?

A: No, taking a 401k loan is a legal right under ERISA. Employers cannot retaliate against you for using plan benefits.

Q: Will a 401k loan appear on my credit report?

A: No, 401k loans don’t involve credit checks and won’t show up on credit reports since you’re borrowing from yourself.